2 Investing Principles When “This Time Is Different”

Economic events like what we’re facing today naturally raise pessimism. The thought process often goes, “The stock market has eventually gone back up in the past, but this time is different, and what if it doesn’t this time? I can’t afford for the market to be down for a long time. Maybe I should just get out or maybe I should wait to invest until things settle down.”

If markets didn’t always go back up, we would all have much bigger problems than our investment balances. If we could reliably avoid market downturns, there would be no risk and therefore no return. By definition, it has to feel like “this time is different” or else there’s no reward for investing through uncertainty.

In light of this, here are two investing principles to keep in mind when “this time is different”:

1) Live Your Life

There’s always been a “reason to sell.” Even when markets hit all time highs, the headlines still shout warnings to get out before it drops. Thinking back over the last decade, there’s been a lot in the way of crises. Take a minute to consider. If you have trouble remembering, this chart will help:

From government shutdowns to Brexit, to inverted yield curves and COVID, the evidence is clear:

The “reasons to sell'' are always different, but if you’re looking for a reason to sell, you’ll find one. My advice when you’re feeling the anxiety creep in: Turn off the TV and social media for a little while. Get out and exercise. Just take a deep breath and live your life.

Thankfully, waiting for a recovery tends to be shorter than you might think. Historically, bear markets (a 20% drop from the previous peak) have averaged about 10 months. On the other hand, bull markets average about 55 months¹:

While the recovery interval never feels as short as it typically ends up being, waiting out the downturn is worth it. Finance expert and author Morgan Housel put it this way:

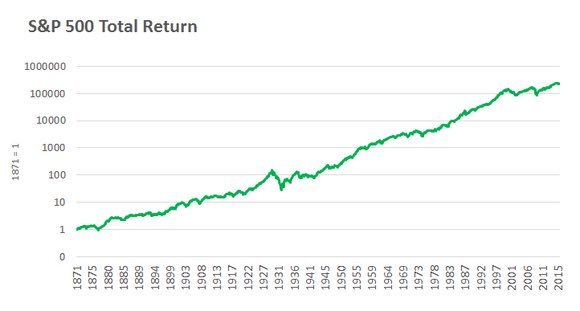

“A book called Shut Up and Wait, and every page is just this chart”:

2) Keep Investing

If you’re a long term investor, don’t get out of the market. In fact, keep getting in. Granted, it’s easier said than done. Years ago, Morgan Stanley put out a chart illustrating how investor behavior is often correlated to stock market performance:

Like clockwork, beginning from 1995 until 2009, investors bought into equities when markets were going up and took money out when markets were going down. Getting out of the market, especially during a drawdown will significantly dilute investment returns. Systematically investing no matter what the market is doing (A.K.A. dollar-cost averaging) will prove to be “buying low” over the long run.

The other issue with attempting to time the market is it forces you to make two decisions, where both have a low probability of success. Even if you “win” on the decision of when to get out of the market (which you will only know in hindsight), you also have to get the second decision correct for the first one to matter. From a probability standpoint, mathematicians would say you’re crazy! This is why I would argue that getting out of the market during a downturn is actually “riskier” than riding the downturn out. You “risk” missing a top-performing day while you’re out, and history has shown how detrimental that can be:

While I cannot predict what will happen next, I am confident that human nature isn’t changing anytime soon. I’m willing to bet that innovation in the face of a myriad of challenges will continue to drive markets up over the long run like it has throughout history:

If you want to understand more about how this concept can be applied specifically to your situation, talk to a financial planner. They will help keep you disciplined in an investment process that has a high probability of success to reach your goals, considering a wide range of market outcomes.

¹ https://my.dimensional.com/dfsmedia/f27f1cc5b9674653938eb84ff8006d8c/39602-source/bulls-bears-and-long-term-benefits-of-stock-investing.pdf