Investing In Stocks Isn’t Seasonal - It’s For A Lifetime

In times of inflation or deflation, bear market or bull market, early in your career or late in retirement, owning stocks is the best way to ensure you can preserve your lifestyle. Why? Because historically, there’s no other asset that has outpaced inflation quite like stocks. In this blog, I explain 3 reasons to be a lifetime investor in stocks.

1) Your biggest risk is not volatility - it’s the loss of purchasing power

First of all, the biggest risk to you is not the volatility of your account balance. The biggest headwind that you face is the loss of purchasing power. While inflation comes in waves (and we’re riding a big one right now), inflation averages about 2.5%-3.0% annually over the long run. Your main concern shouldn’t be investing in a volatile stock market - it should be whether or not you’ve invested enough in stocks! Here’s a chart with the growth of $100 dollar plotted since 1926 with all the recessions that occurred along the way outlined in green:

2) Investing in stocks is capitalizing on human ingenuity

Another reason to be a lifetime stock investor is this: work, productivity, and ingenuity are a part of human nature. There may be a temptation to think that believing in humanity’s ability to weather difficulty is misguided. However, we should not be surprised that when humanity faces difficult economic times, innovation occurs. While some companies will ultimately fail, many adapt and grow in unimaginable ways, and the economy produces more again. David Booth, Executive Chairman and Founder of Dimensional Fund Advisors, explains how investing is tied to human ingenuity:

“By investing in a market portfolio, you’re not trying to figure out which stocks are going to thrive, and which aren’t going to be able to recover. You’re betting on human ingenuity to solve problems. The pandemic was a big blow to the economy. But people, companies and markets adapt… Whatever the next blow we face, I have faith that we will meet the challenge in ways we can’t forecast.”

We are facing another blow with inflation, and no one can forecast when or how exactly this challenge will be overcome. However, I firmly believe that inflation will slow down and the stock market will recover.

3) The best investors stay “Under the Faucet”

Finally, lifetime investors place themselves “under the faucet” at all times. What does this mean? I heard an analogy once about being “under the faucet,” and it applies well to investing. This metaphor illustrates how we have to be “under the faucet” in order to catch the rush of water when it turns on. While we don’t know when the faucet will turn on, we need to be ready for when it does. Otherwise, we’re at risk of missing it altogether!

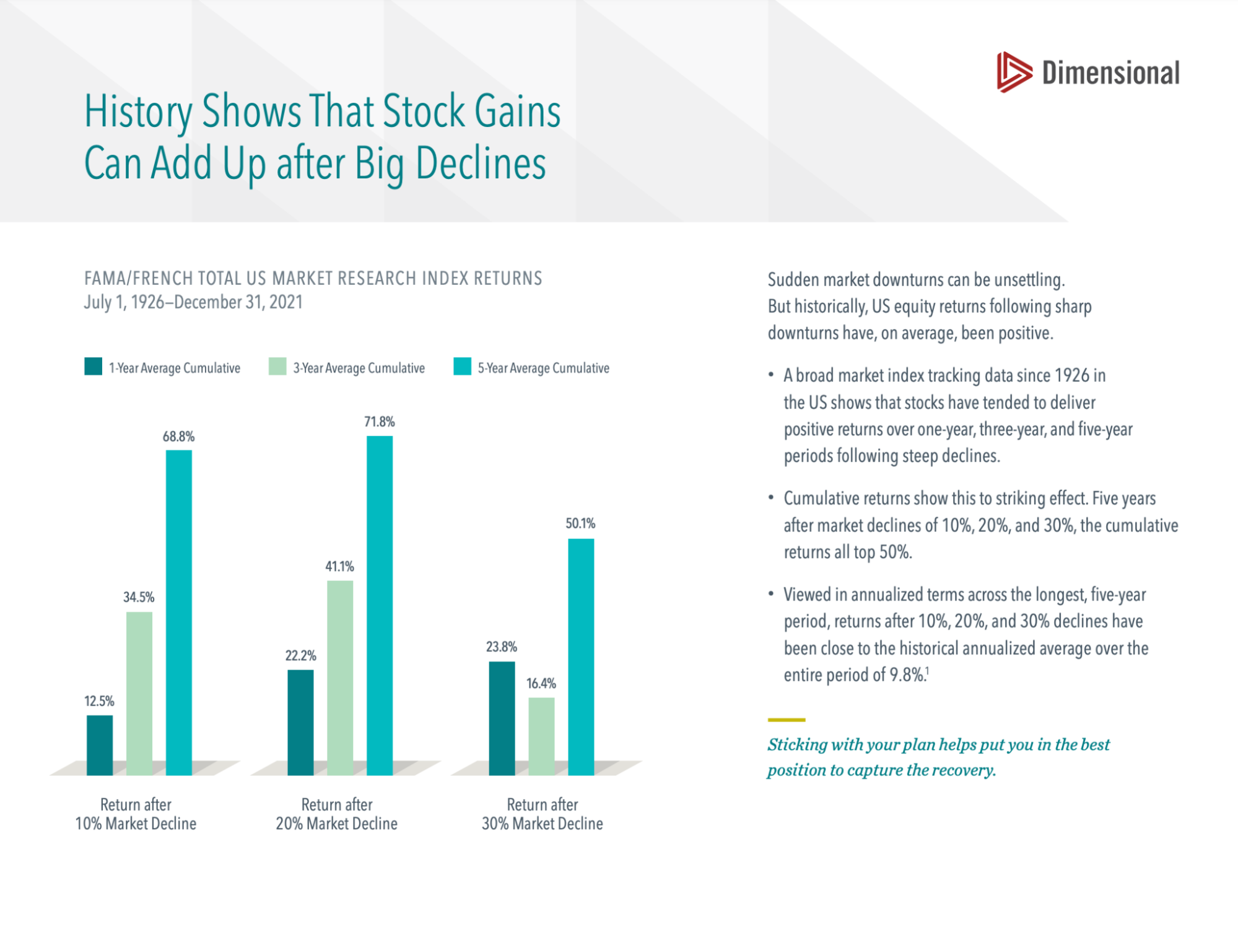

Similarly, the rewards of investing are there for those willing to stay “under the faucet.” For investors, that means sticking to your investment plan and not deviating when times are tough. History tells us that the best days in the market come shortly after market downturns. If we try to limit losses or get out of the market, we will not be able to fully capture the recovery. Check out this Dimensional chart which shows how incredible gains from the stock market have been immediately after a steep decline:

The 1, 3, and 5 year cumulative returns after 10%, 20%, and 30% market declines are all positive and range from 12.5%-71.8%. Staying the course in a bear market will allow you to experience all of the benefits of a bull market.

Our advice is this: Stick to your investment plan, and trust the process!