Managing Cash Flow As A Solo Business Owner

If you’re a solo business owner, you’ve more than likely struggled with cash flow. If you have, you’re not alone. This Intuit study found that 61% of small businesses have problems with cash flow. Having a framework for managing income is essential to create margin and be successful. In today’s blog, I lay out 4 steps that any solo business owner can implement to be confident in maximizing variable income.

1) Establish the right bank accounts to keep business and personal finances separate.

This is a critical first step to ensure that a cash flow system can be implemented. You will need these 6 bank accounts to implement the structure presented today:

Main business checking account, registered in the name of your LLC (Sole proprietors need a separate personal checking account for this)

Business savings account, registered in the name of your LLC (Sole proprietors need a separate account personal savings account for this)

Main personal checking account

Personal savings account (Some opt to have multiple personal checking accounts for various personal savings goals, but that’s outside the scope of this blog)

Taxes checking account

Retirement contributions checking account

2) Know how the flow of cash should work and do it.

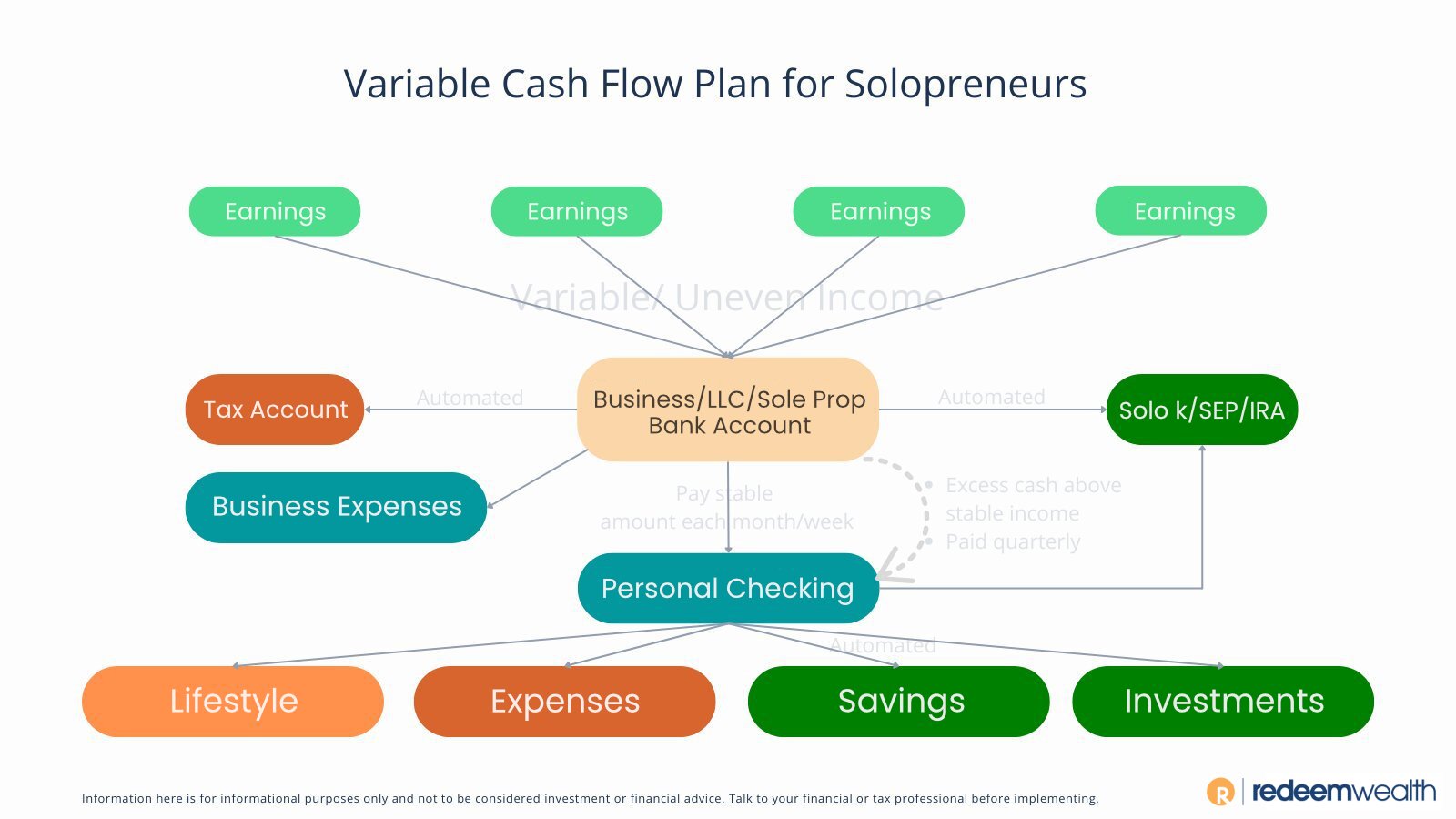

Take some time to understand and then implement the flow of cash, which is pictured below. Travis Gatzemeier, CFP and owner of Kinetix Financial Planning created the original version of this visual aid, which is extremely helpful:

Here’s the movement explained: Anytime your business generates income, that gets deposited to your main business checking account. All business expenses should get paid from the business checking account (or if you have a business credit card, make payments from this account every month to fully pay off the balance). Additionally, make automated transfers from your business checking account every month to your taxes and retirement checking accounts. You will know these amounts by projecting out your tax liability and factoring in IRA or small business retirement plan contributions (If you need help with this step, work with a financial planner and tax professional!).

The final monthly transfer out of your business checking account will be to your main personal checking account. The key here is to make this amount a stable amount (automating this weekly or monthly transfer is best!), thereby establishing a “paycheck” for yourself. This is a critical step in the process, as it creates the experience of consistency even when your income is inconsistent.

3) Fund your business and personal savings accounts.

Another vital step in the process of establishing this structure is funding your business and personal savings accounts. Some financial professionals refer to these types of accounts as an emergency fund, but ultimately their purpose is to ensure the consistency of this process. When you have a month or a quarter with lower business earnings, keep the same exact process in place. Instead of funding your main business checking account with business earnings, fund it from your business savings account if needed. Likewise, when you have unexpected large personal expenses, use your personal savings account to fund those unusual expenditures. The amount that you need to keep in these savings accounts will vary based on your business and personal financial situation, but a good rule of thumb is 6 months of business expenses for your business savings and 6 months of expenses for your personal savings.

It’s important to note that while some people feel guilty moving money out of their savings accounts when stretches of lower earnings occur, keep in mind that’s exactly what those accounts are designed to do. You’re using the account for the very purpose you established it for in the first place. Don’t feel guilty - the process is working!

4) Use excess earnings wisely.

Know the plan ahead of time for when you have a month or a quarter with higher than expected earnings. There’s multiple ways to effectively use excess earnings, but here are a few of my favorites:

Top off your business and personal savings accounts. If you’ve withdrawn from savings or your monthly expenses have increased, these accounts will be underfunded. In either case, use excess earnings to keep them at their target levels.

Reinvest in your business. Use excess earnings for larger business expenses that help you operate your business more effectively and efficiently. This is a great way to grow your income - investing in your business can have some of the highest returns of anything you do!

Fully fund retirement accounts. Many times, business owners are not taking full advantage of the retirement contributions that are available to them. In the event of significantly more business earnings than expected, this can be a great option. Especially for those who will reach the highest tax brackets, deferring income into retirement plans is a fantastic way to potentially lower your lifetime tax bill.

Move excess earnings to your personal checking account for an extra “paycheck”. This is a great option to reward you and your family for all the hard work you put in! Spend it, give it, fund a non-retirement investment account, put a little extra in the vacation fund, or do anything else that you and your loved ones value. It’s important to celebrate the wins!

Knowing and executing are two different things.

If this structure resonates with you, but you’re not entirely sure how to implement it for your business, feel free to reach out to us here at Redeem Wealth. Scheduling a time with a financial planner and tax professional is an extremely valuable use of time for any business owner, as they can help tailor this structure to your specific industry and situation. Additionally, the various retirement plan options and tax implications unique to business owners are two of the many things that we can help with!