What is the Effect of Republican or Democrat Control on the Stock Market?

It is not uncommon for investors to raise concerns when governmental control shifts from one party to another. It’s intuitive that the policies of these two different political parties have an effect on the economy and corporate profits. But you may wonder, what is the effect of political power on the performance of the stock market?

News pundits would have you believe there are direct correlations. However, the data is not so clear or predictable. Based on data from 1926 onward, it is reasonable to conclude that neither the republican nor democrat policy is a primary driver of stock market performance one way or the other. Why might that be? It is largely due to the fact that political power is only one of thousands of variables that drive stock market returns on a daily basis.

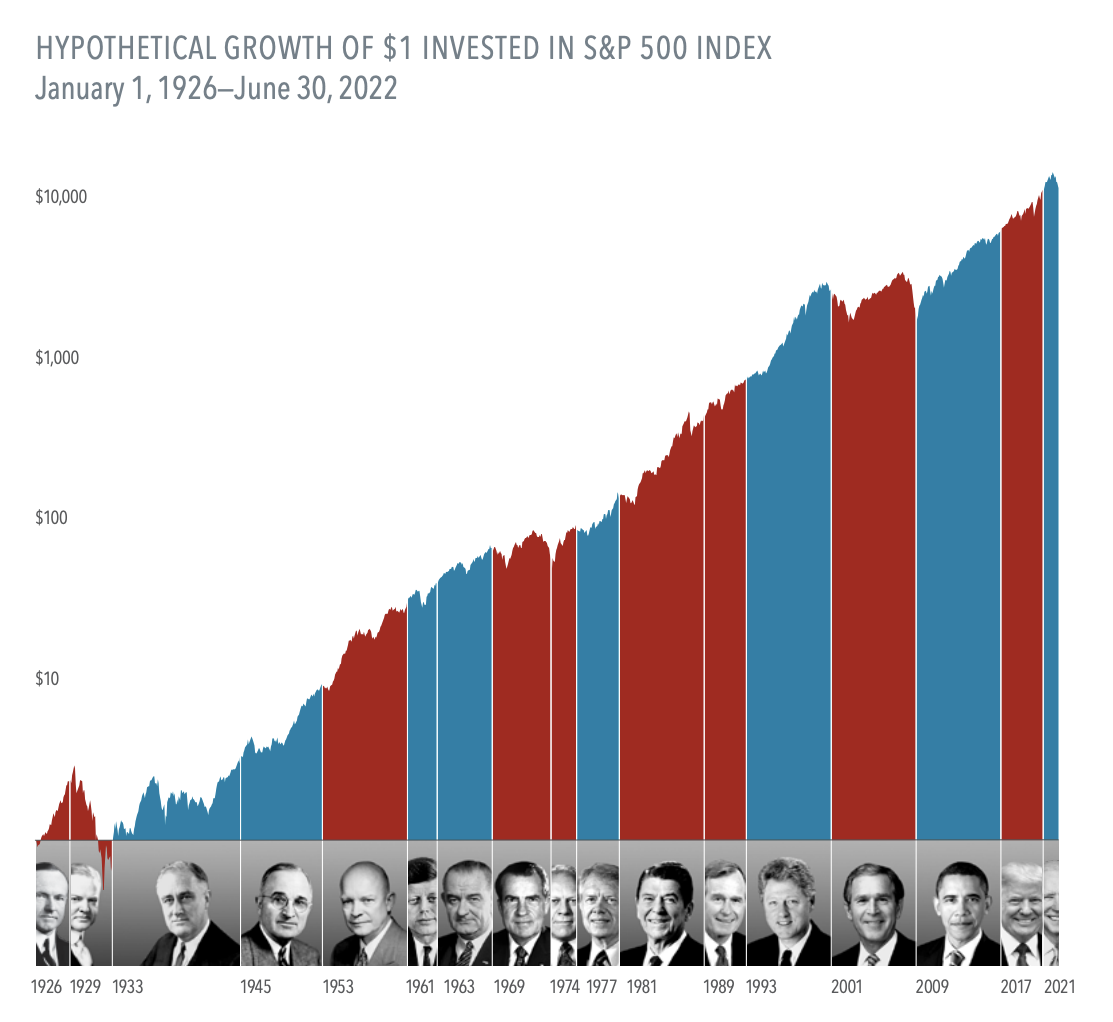

There have been 14 years since 1926 where Republicans have controlled the presidency, congress, and the judicial branch. On the other hand, there have been 34 years years that Democrats have had full control. How did the stock market perform in each of those instances? In the years of Republican control, there was a 14.52% annualized return. In the years of Democrat control, it was the exact same result out to two decimal places: 14.52%! Here’s the years of Republican, Democrat, and mixed control color-coded with the growth of a $1 over those stretches:

Interestingly enough, the data is similar if you look solely at the control of the presidency.

Historically, the stock market has trended up no matter what party holds the presidency¹. Again, why might that be? Consider this: As an investor, you own shares of companies. Companies are always innovating and looking for ways to serve their clientele and grow their business, regardless of who’s in office. Aside from policies set by the federal government, technological advances, oil prices, the actions of foreign leaders, or a global pandemic (among thousands of other examples) are all additional factors that drive economic growth and market returns.

I do believe that investors should advocate for their most fundamental beliefs! I also believe investors shouldn’t make dramatic shifts in their investment portfolio if the party in power isn’t their own. As investors, we need to understand our own biases and rely on data to drive our investment decisions. It’s natural to focus on one thing as the driver of future stock market returns, but investors have been rewarded for staying disciplined over both Republican and Democratic control of government.

If you have questions on any of this or want to talk about how you are invested, schedule a time to chat with us at Redeem Wealth. We’d love to make sure you’re set up for success as an investor and doing the things that matter most in reaching your goals.